Dubai Property and Crypto

Dubai has become one of the few global hubs where cryptocurrency and real estate truly meet. The emirate’s forward-thinking regulators and bold developers have turned digital assets into a real pathway to property ownership.

If you are holding Bitcoin, Ethereum, or stablecoins, you might be asking: Can I buy a home in Dubai with crypto?

The answer is yes, but with structure and rules. This guide explains what’s possible in 2025, how the process works, which developers are crypto-friendly, and what global investors need to know before making a move.

How Dubai Regulates Crypto Property Deals

Unlike many other markets, Dubai has a clear framework for real estate purchases involving cryptocurrency. Two main authorities oversee the process:

Dubai Land Department (DLD) – Manages all property transactions and issues title deeds.

Virtual Assets Regulatory Authority (VARA) – Regulates digital assets and licensed crypto service providers.

Key rules buyers must know:

All property contracts are denominated in AED (UAE dirhams), not in Bitcoin or Ethereum.

Payments must go through a licensed crypto exchange or regulated payment partner.

AML (Anti-Money Laundering) and KYC (Know Your Customer) checks are mandatory.

This means no developer is taking a suitcase of Bitcoin directly. Instead, your crypto is converted into AED at the time of the deal, ensuring transparency and compliance.

Step-by-Step Process to Buy with Crypto

Here’s how a crypto-to-property transaction typically works in Dubai:

- Work with a licensed real estate agent who understands crypto deals (Me ;-)).

- Research your project, unit type, and choose a developer or resale property that supports crypto transactions. Including understand the developer terms.

- Let your agent negotiate the deal including fees deciding on the final price is the final step before commitment.

- Decide with the developer on the crypto payment method whether you are going to pay all in crypto, the booking fee by bank transfer and the down payment by crypto, or you want to exchange your crypto into a managers cheque.

- Funds are transferred to the developer complete the booking paperwork and pay fees to initiate the deal. Most use USDT if direct crypto transfer.

- Sign the Sales and Purchase Agreement (SPA), denominated in AED.

- Register ownership with the Dubai Land Department (DLD) and receive the title deed/oqood

👉 Important: You will never see a Dubai property deed showing Bitcoin or Ethereum. Ownership is always registered in AED.

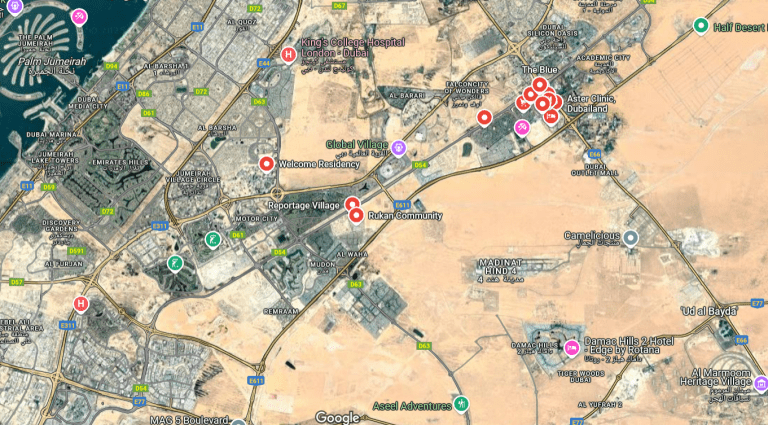

Developers in Dubai Who Accept Crypto (2025 Update)

Several leading developers now support crypto payments through regulated partners including:

DAMAC – Known for luxury towers and branded residences.

Beyond – Powered by Omniyat.

Ellington Properties – Focus on boutique, design-driven communities.

MAG – Large-scale developments including luxury waterfront projects.

Binghatti – High-rise buildings in central Dubai locations.

Most of these developers accept BTC, ETH, and USDT, often through exchanges, partners, or licensed intermediaries.

Myths vs Reality

Let’s clear up some common misconceptions when purchasing property in Dubai with Crypto:

Myth 1: I can buy any Dubai property directly with Bitcoin.

Reality: Only select developers and resale sellers allow it.Myth 2: Property prices are quoted in BTC.

Reality: All pricing and contracts remain in AED.Myth 3: There are no regulations.

Reality: VARA and DLD enforce strict compliance with AML/KYC rules.Myth 4: Crypto eliminates fees and paperwork.

Reality: You still pay standard DLD registration fees, admin fees, and follow normal legal procedures for a property transaction.

Why Global Investors Use Crypto in Dubai

The appeal is clear:

Speed: Cross-border transfers are completed in hours rather than days.

Accessibility: Investors who hold wealth in crypto can diversify into real estate without heavy banking friction.

Global market: Dubai’s property sector welcomes international buyers, with no restrictions on foreign ownership in designated freehold zones.

Yields and growth: Dubai continues to offer attractive rental returns and capital appreciation, making it a top global market.

Risks You Should Not Ignore

Despite the opportunities, crypto real estate in Dubai is not without risk:

Volatility: If Bitcoin drops 10% during a transaction, your purchasing power changes. Many buyers use stablecoins (like USDT) to avoid this.

Irreversibility: Crypto transfers cannot be reversed if you send funds to the wrong wallet.

Scams: Fake brokers or unlicensed exchanges can create legal and financial problems.

Regulatory oversight: Authorities require full KYC. If you cannot prove the source of funds, the deal will collapse.

The smart move is to use a stablecoin, a licensed broker, and a regulated payment platform.

To Wrap Things Up

Dubai has positioned itself as a global leader in combining real estate with cryptocurrency. But while the headlines make it sound futuristic, the process is structured and regulated.

If you want to buy property in Dubai with crypto in 2025:

Choose a developer that accepts it.

Work with a licensed broker.

Use regulated exchanges for conversion.

Always expect contracts and deeds in AED.

Crypto may be the bridge, but Dubai’s property market remains grounded in transparency and law.

For global investors, that’s exactly what makes it attractive.